Small deposit mortgages kickstart new year

February 2018 | By Esurv Staff

It was a positive start to the year for the UK mortgage market, with an increase in the number of small deposit mortgages being approved.

The latest Mortgage Monitor from e.surv found that 21% of all approvals went to small deposit buyers, well above recent months. In December 2017, 18.2% of loans were to this part of the market while the month before it was just 17.2%.

January’s data is the second full month of data following the Bank of England’s decision to increase the base rate to 0.5%. This rate rise, plus the speculation in the weeks leading up to the decision, has spurred many people into taking action, either looking to take out a mortgage or switching to a new deal.

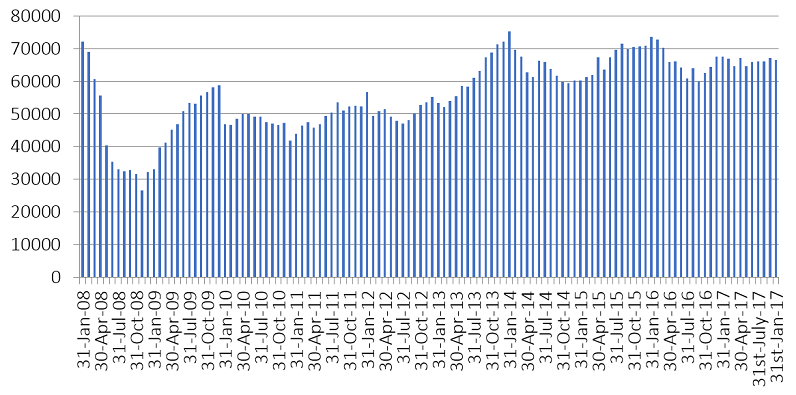

These customers have now started to filter through to the approvals data, given the length of time it takes for a mortgage application to complete. The latest data reports there were 66,484 mortgages approved (seasonally adjusted) during January 2018.

There was good news for first-time buyers and others with smaller deposits as the proportion of loans to this market segment increased compared to last month.

Richard Sexton, a Director of e.surv Chartered Surveyors, comments:

“We are now starting to see the effects of the Bank of England’s decision to increase the base rate filtering through to the market.

“While it is now two months on from the base rate rise, we are starting to see those who were alarmed by the talk of increased rates finalise new mortgage deals, whether with their existing lender or elsewhere.”

Monthly number of total sterling approvals for house purchases (seasonally adjusted):

As the proportion of small deposit mortgages rose, there was a fall in the amount of approvals to those with large deposits.

In December 35.9% of all mortgage approvals went to large deposit buyers – defined by this survey as those with a deposit of 60% or more. One month on and this had dropped to 33.5%. This continues a recent downward trend from the 36.5% rate recorded in both October and November.

The proportion of loans going to mid-market borrowers also fell slightly, compared to December. In January this market segment represented 45.5% of the overall market, lower than the 45.9% figure found a month ago.

On an absolute basis, the survey recorded that there were 13,962 loans to small deposit borrowers during January 2018.

Richard Sexton, a Director of e.surv Chartered Surveyors, comments:

“First-time buyers and others with smaller deposits have experienced a strong start to the year, with the proportion of loans rising compared to the end of 2017.

“While other types of borrowers have been squeezed, the larger overall mortgage market means that more people are getting approved than a month ago.”

Proportion of large deposit loans by region:

At the start of 2018, the North West was the region which saw a higher proportion of loans approved to small deposit buyers than anywhere else.

The survey found 31.1% of all loans in the North West went to these borrowers in January 2018, well ahead of the 28.1% found in December 2017.

This puts the region ahead of Yorkshire – where 30.3% loans went to this market segment this month – and Northern Ireland, which recorded 28.9%. However, only the North West and Yorkshire saw more loans go to small deposit buyers than their larger deposit counterparts.

At the other end of the scale, buyers in London face the biggest struggle with 16.6% of loans approvals going to borrowers with small deposits. In the capital 36.7% of all loans went to those with a larger amount of equity.

However, this was slightly lower than the rate found in the South East (39.1%) and Scotland (38.1%) regions.

Proportion of small deposit loans by region:

Richard Sexton, a Director at e.surv Chartered Surveyors, concludes:

“We know that raising a deposit is one of the most difficult tasks would-be homeowners face. House hunters in London face an uphill struggle to get themselves a big enough deposit to buy, but there are places in the UK which offer much more fertile ground.

“In the North West and Yorkshire there are more mortgages approved to buyers with smaller deposits than those with a large cash pile, both are ideal places to get your foot onto the property ladder.”

Data source: e.surv Chartered Surveyors

Data from: January 2018