Over a fifth of mortgages go to small deposit buyers

May 2018 | By Esurv Staff

There was good news for first-time buyers and others with small deposits, as these buyers accounted for more than a fifth of the UK mortgage market during April 2018.

The latest Mortgage Monitor from e.surv, one of the UK’s largest residential chartered surveyors, shows a rise in the proportion of loans going to these buyers compared to last month.

The survey found 20.2% of all mortgages went to this segment of the market during April, versus 19.6% the month before.

Both figures are much higher than the most recent low – of 17.2% – which was seen in November 2017.

These figures mask the wide variations between regions, with Northern Ireland seeing more small deposit loans approved than anywhere else.

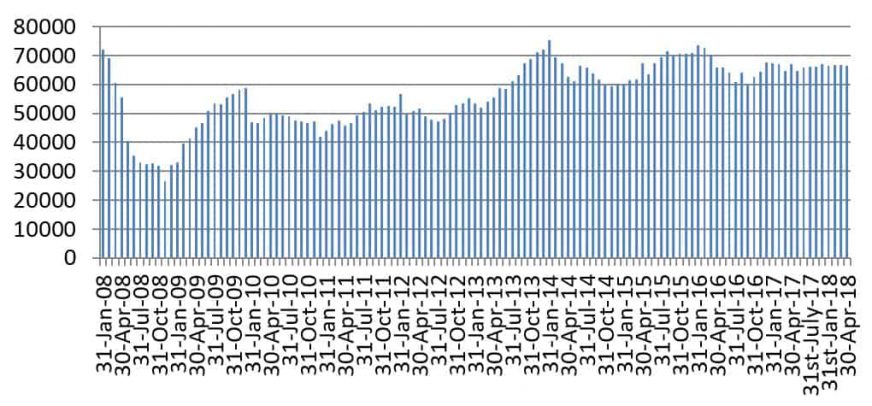

The overall market grew month-on-month but was down slightly compared to April 2017.

Across the UK there were 66,482 mortgages approved (seasonally adjusted) in the month.

This figure is 5.7% higher than March’s total but is a fraction – 0.4% – down compared to the same month a year ago.

Homeowners are now aware that they are in a potentially rising interest rate environment and this is prompting many people to look at their remortgage options.

The previous rate rise in November has now reached those on variable rate mortgages and there continues to be speculation about how many additional rate rises will be seen in the next two years.

Richard Sexton, a Director of e.surv Chartered Surveyors, comments:

“Despite many existing homeowners looking to remortgage, there was a solid increase in the number of loans going to first-time buyers and others with less equity in their properties.

“Overall, the market has grown compared to last month, but is still relatively flat compared to a year ago.

“The next key challenge for the market will be attracting customers into new mortgages while borrowing remains cheap by historical standards.”

Monthly number of total sterling approvals for house purchases (seasonally adjusted):

The proportion of mortgage approvals given to those with a large deposit fell, as first-time buyers occupied more of the market this month.

Large deposit borrowers, defined by this survey as having a deposit of 60% or more, accounted for 33.2% of all approvals this month.

This is lower than 34.5% recorded in March, although that was the high point of 2018 so far. This ratio is higher than the 33.1% found in February, however.

As well as small deposit borrowers, mid-market borrowers also increased their share of the overall mortgage market this month.

Some 46.6% of all approvals were to this borrower category this month, compared to 45.9% in March.

On an absolute basis, there were more small deposit buyers in April than there were in the last survey period.

A total of 13,429 loans were approved to this segment of the market in April compared to 13,056 a month ago.

Richard Sexton, a Director of e.surv Chartered Surveyors, comments:

“As the number of large deposit borrowers fell, smaller and mid-market customers have picked up a higher share of the market.

“In number terms, there was a significant uptick in small deposit buyers compared to a month ago.”

Proportion of large deposit loans by region:

The London market was once again the most difficult place for those with small deposits to get a mortgage.

In April 2018 just 14.9% of mortgage approvals were to those with a small deposit – lower than anywhere else in the country.

By contrast, 39.7% of the loans in the capital went to those buyers with a large amount of equity or cash.

At the other end of the scale, Northern Ireland saw a bigger proportion of loans go to those with small deposits than anywhere else, with 32.2% of all loans going to this part of the market.

However, this market still had a greater proportion of large deposit buyers – 33.9% – than their smaller deposit counterparts.

Yorkshire and the North West were the only two regions which had a greater number of small deposit buyers than large ones.

In Yorkshire 30.8% of the market was small deposit borrowers compared to just 23.2% large deposit borrowers.

In the North West this was 26.6% versus 23.5% in favour of those with small deposits.

The Midlands region (25.5%) was the only other area to see more than a quarter of all loans go to small deposit buyers.

Proportion of small deposit loans by region:

Richard Sexton, a Director at e.surv Chartered Surveyors, concludes:

“Of course, it is not as easy as picking the most favourable market to buy a house. But if a buyer had the ability to live anywhere, it would be northern areas of England and Northern Ireland that looked most attractive in financial terms.

“First-time buyers and others with small deposits made up a greater proportion of the market in Northern Ireland than anywhere else in the country.

“In England, both Yorkshire and the North West offer excellent opportunities for young buyers to get onto the ladder for the first time.”

Data source: e.surv Chartered Surveyors

Data from: April 2018